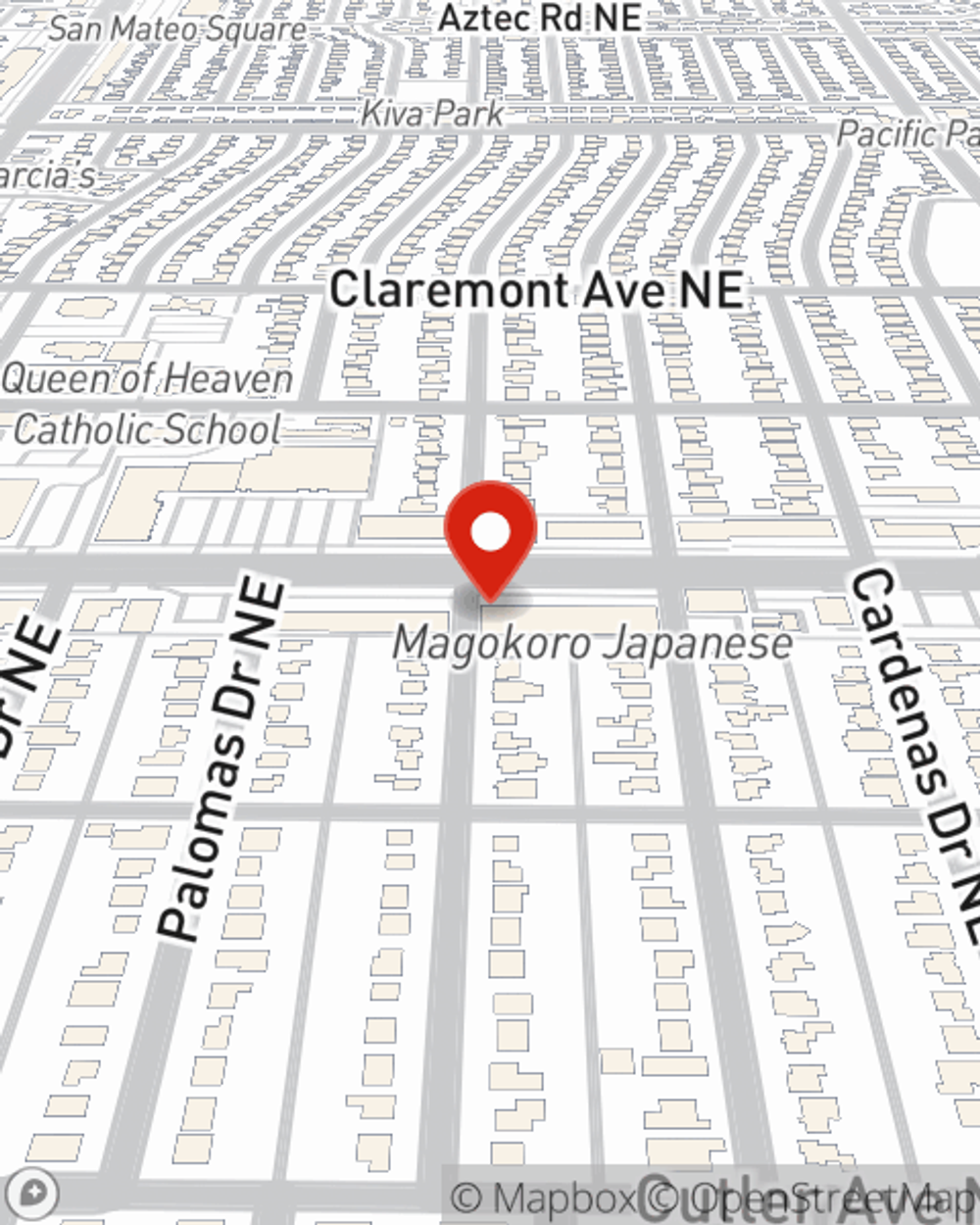

Business Insurance in and around Albuquerque

Searching for protection for your business? Look no further than State Farm agent Lanell Anderson!

Cover all the bases for your small business

State Farm Understands Small Businesses.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, trades, contractors and more!

Searching for protection for your business? Look no further than State Farm agent Lanell Anderson!

Cover all the bases for your small business

Protect Your Future With State Farm

Every small business is unique and faces a wide array of challenges. Whether you are growing an art store or a bridal shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Lanell Anderson can help with extra liability coverage as well as key employee insurance.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Lanell Anderson's team to identify the options specifically available to you!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Lanell Anderson

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.